[ad_1]

When you’re first starting out as an entrepreneur, it can be easy to see all the revenue coming in and think you’re set when it comes to profits. However, if you’re not sure how much money your business makes versus what costs are required to keep it running, you won’t be able to set an adequate operating budget.

An operating income formula enables you to determine precisely how much money your business earns after expenses. In this article, we’ll talk about what this equation is and how it works. We’ll also go over some tips to keep in mind when using it.

Let’s get to it!

What Is an Operating Income Formula?

In accounting, an operating income formula tells you how profitable your business is. Although the exact equation can vary, in essence, it comes down to determining how much money your business makes after you subtract its operating expenses.

In other words:

operating income = gross income – operating expenses

You may also sometimes see operating income referred to as “operating profit” or “Earnings Before Interest and Tax (EBIT). These terms simply account for what factors you include in your operating expenses. For example, EBIT refers to your business’ profits before you pay income taxes and interest expenses.

Usually, businesses calculate operating income every month. Gross income refers to how much money your business earned during that particular month. Traditionally, it only considers direct earnings and not other profits your business generates (through investments, for example).

Calculating operating expenses tends to be a bit trickier. They generally include all of the following:

- Rent

- Utilities

- Employee wages

- Insurance

- Supplies

Basically, any cost you have to cover to keep your business running on a day-to-day basis falls under the umbrella of operating expenses. However, in most cases, operating expenses don’t include taxes or other one-off costs that may skew your budget.

What Your Operating Income Can Tell You

A mistake many entrepreneurs make is believing that gross income is the most important indicator when it comes to business success. However, if your operating expenses are so high that you only have a tiny profit margin, then you’re actually not in as comfortable a position as it may seem.

In some cases, a low profitability margin is nothing to panic about. However, it can also point towards structural issues with your business, such as:

- Unnecessary recurring expenses. One of the most common problems with new businesses is that owners spend money on things they don’t need.

- Problems with your pricing strategy. Your prices might be too high, which makes your products or services less desirable. Or, they may be too low to cover your expenses.

- Low employee efficiency. It may be the case that the wages you pay don’t directly translate to the work your employees put in. However, this usually has more to do with leadership than with accounting.

Although a business can survive on a low profit margin, it doesn’t put you in a good position. Without a healthy operating income, you can’t save money for periods where your business doesn’t bring in enough revenue to cover operating expenses. Moreover, you miss out on the opportunity to re-invest money into your company or to invest in other projects.

Knowing how to calculate your operating income is only half of the battle. You also need to track those numbers closely over the long term. That way, you’ll be able to spot downturns in your business early and make decisions that will help you weather them.

How to Calculate Your Operating Expenses

Before you can determine your operating income, you need to calculate your operating expenses. As we mentioned earlier, this can be somewhat tricky. Every business is different in this regard, so there’s no master list of every factor you need to take into account here.

As a business owner, it’s part of your job to know your costs and track them diligently. An operating income formula shouldn’t include estimates, but hard numbers. If you’re just starting out, we recommend you monitor expenses by saving your receipts and other documentation that shows how much you’re spending and earning.

As a rule of thumb, you only want to include recurring costs so you can track how much money it takes to operate your business, monitor changes, and find ways to optimize your expenses. For example, let’s say you run an online blog that earns money through affiliate programs.

In that case, your operating expenses would include web hosting, your domain name renewal, and anything you spend on content creation (such as hiring writers or video editors, or even subscriptions to programs such as Photoshop).

Naturally, that’s an over-simplified example. If you run a sizable online store, your operating expenses might also include web hosting and domain renewal, as well as employee wages, insurance, product return costs, online ads, referral commissions, and more. If you also have a brick-and-mortar location for your business, there will be expenses associated with that, too.

As we said, every business is different, so the only way to determine what your operating costs are is to take a good hard look at your own setup. Double and triple check your itemized list of expenses, as any mistakes here will seriously skew your operating income formula results.

Tools to Help You Calculate Your Business’ Operating Income

The hardest part of calculating your operating income isn’t the formula, per se, but ensuring you’re accounting for all your income and expenses. If you have that data ready, then most tools will give you an accurate value.

As you might imagine, there are a lot of tools you can use to help you calculate your business’ operating income. However, one of the simplest is to just use a spreadsheet.

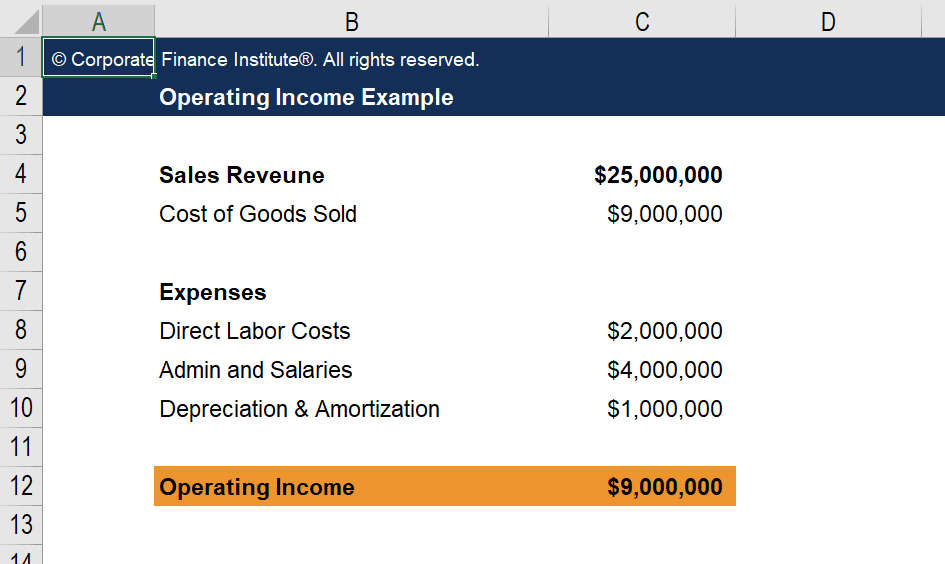

One of our favorite templates for calculating operating income is from the Corporate Financial Institute. This spreadsheet accounts for labor costs, administrative wages and salaries, and depreciation and amortization:

Ideally, we’d recommend you create your own operating income formula spreadsheet. That way, you can itemize all of your business’ specific operating expenses instead of bundling them together under predetermined values. This approach will also enable you to monitor changes in your expenses in more detail.

Another tool you can use if you don’t like the Corporate Financial Institute template is the EDUCBA Operating Income Excel Template. It includes five different example spreadsheets with varying levels of specificity. There’s also the EDUCBA Operating Income Calculator. If you already know your gross income and operating expenses, you can use this tool to quickly get your operating income.

Conclusion

Your business can’t succeed if you’re not sure how much money it’s actually making after expenses. Gross income might look good on paper, but it can be deceptive depending on how much it costs to run your business.

Knowing how to calculate your operating income and tracking both revenue and expenses over the long term is essential. This will help you determine how much money you can save or re-invest in your business. It may even reveal expenses you need to cut for your company’s health.

Do you have any questions about how to use an operating income formula? Let’s talk about them in the comments section below!

Image by Abscent/shutterstock.com

[ad_2]

Source link